Hello Quality & Sourcing Professionals!

🌍 International Product Sourcing Made Simple, Safe & 100% Quality Assured

Build a Zero-Risk Supply Chain With Trusted Suppliers, Verified Processes & Independent Quality Control

Global sourcing is full of opportunities—but also full of risks. Choosing the wrong supplier, receiving poor-quality products, facing shipment delays, or failing compliance standards can damage your business reputation instantly.

At QIV Global, we make international sourcing secure, transparent, and completely quality-driven. Whether you’re sourcing from Asia, Europe, Africa, or LATAM, our specialists ensure you get the right supplier, the right product, the right quality, and the right price—every time.

⭐ Why Smart Companies Trust QIV Global for International Sourcing Support

✔ Reliable & verified suppliers

✔ Zero-defect production approach

✔ 100% independent quality inspection

✔ Technical audits & compliance assurance

✔ Global coverage across 33+ countries

✔ Faster lead times with proactive monitoring

✔ Lower cost of sourcing—no surprises

Your Complete Sourcing Journey, Managed With Confidence

We support every step of your international sourcing process, from finding suppliers to ensuring final shipment quality.

1️⃣ Market Research & Country Selection Understand the best sourcing destinations—before you invest.

We help you choose the ideal manufacturing country by analyzing:

- Production clusters

- Raw material availability

- Labour skill level

- Political & logistics stability

- Regulatory & compliance requirements

Result: You source smarter, safer, and more cost-effectively.

2️⃣ Supplier Discovery & Shortlisting Find real, legitimate, high-performing factories.

We verify factories to protect you from:

- Fake suppliers

- Shell companies

- Misrepresentation

- Capacity mismatch

Our Services:

- Supplier verification

- Background checks

- Remote or on-site validation

Result: Confidence in choosing the right supplier.

3️⃣ Supplier Audits & Capability Assessment

Know exactly what your supplier can deliver.

Our audit experts assess:

Machinery & technical capability

Production capacity

Quality management system

Social & environmental compliance

Material supply chain integrity

Result: You partner only with safe, capable, and globally compliant manufacturers.

4️⃣ Product Sampling & Technical Validation

Ensure accuracy before mass production starts.

We verify:

Materials and components

First production sample

Compliance and lab testing

Packaging and labeling standards

Result: What you approve is exactly what will be produced.

5️⃣ Price Negotiation With Quality Protection

Get the best price—without hidden compromises.

Our early inspections and material checks prevent suppliers from:

Lowering material quality

Changing components

Reducing specifications secretly

Result: A fair price with guaranteed quality integrity.

6️⃣ Production Planning & Timeline Control

Transparent, real-time production follow-up.

Common delays come from overbooking, material shortages, and poor planning.

We prevent these with:

Production monitoring

Readiness verification

Daily or weekly reports

Early detection of delays

Result: Your products stay on schedule.

7️⃣ Multi-Stage Quality Inspections

Catch defects early—avoid costly surprises later.

We conduct:

Initial Production Check (IPC)

During Production Inspection (DUPRO)

Pre-Shipment Inspection (PSI)

Rework & Sorting Verification

Result: Zero-defect approach that protects your brand reputation.

8️⃣ Final Shipment Verification & Container Loading Supervision

Your last line of defence before the goods leave the factory.

We verify:

Quantity, labeling, and packaging

AQL-based product quality

Proper loading pattern

Container condition and seal integrity

Result: Safe shipment, correct products, no mix-ups.

9️⃣ Continuous Improvement & Supplier Scorecards

Strengthen your supply chain long term.

We provide:

Defect trend analysis

Corrective action verification

Supplier performance ratings

Annual/periodic re-audits

Result: A reliable, predictable, high-performance sourcing ecosystem.

🔒 Build a Zero-Risk Global Supply Chain

With QIV Global, you eliminate:

Quality failures

Production delays

Supplier fraud

Compliance issues

Unsafe materials

Shipment losses

Hidden subcontracting

You gain full quality confidence, while keeping costs under control and ensuring products reach your warehouse on time.

💡 How QIV Global Adds Value to Your Sourcing Operations

📌 Quality Inspection Services

Pre-Production Inspections

Initial Production Checks

DUPRO / In-Line Monitoring

Pre-Shipment Inspections

Container Loading Supervision

Defect Sorting & Rework Validation

📌 Supplier Audit Services

Factory Quality System Audit

Manufacturing Capability Audit

Social Compliance Audit (SEDEX/BSCI)

Environmental & Chemical Safety Audit

C-TPAT Security Audit

Anti-Fraud & Anti-Corruption Audit

What are the critical considerations for successful international sourcing?

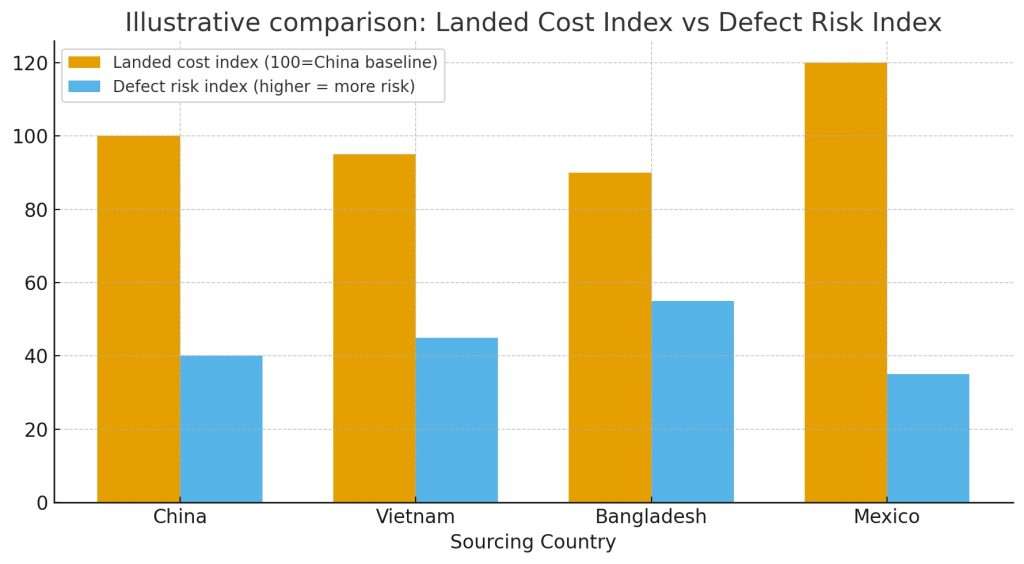

When a Head of Quality or Sourcing sources internationally, they’re balancing cost, lead time, compliance, and brand risk — and they quantify those trade-offs before selecting a country or supplier. For example, product-recall exposure can easily run into multi-million dollar losses for consumer brands; prevention via stronger inspection, better supplier controls, and tighter AQLs is almost always cheaper than remediation. Key operational drivers in the decision are: – True landed cost (unit price + logistics + duties + rework/recall risk). – Defect tolerance (AQL) and critical-defect policy (critical = 0 allowed). – Lead time and agility (ability to respond to SKU bursts or recalls).

- Many companies sourcing globally underestimate the cost of quality failures, compliance and supply-chain complexity. One survey found that while transportation and customs costs were regularly measured, compliance, quality and out-of-stock costs were “harder to quantify” in global sourcing decisions.

- A research project introduced a “Total Cost of Sourcing” model for global factories – explicitly including product cost, quality assurance cost, social-compliance cost, and switching cost – to capture landed cost plus risk.

- In the practical language of sourcing/leaders: this means that even if a supplier offers a lower unit price, if lead time is longer, quality risk is higher, or compliance monitoring is weak, the true landed cost may exceed alternatives.

A brand’s weakest supplier can create the greatest risk: “Your brand is only as good as your weakest supplier… Pulling a product off the market and compensating those impacted … can cost millions of dollars.”

Literature on product recalls emphasises that delays or failures in addressing defects significantly damage firm reputation and increase cost.

For sourcing leadership this means: define acceptable major‐defect levels (e.g., AQL), treat critical defect levels as zero tolerance, and ensure suppliers commit to those standards + allow audit/inspection verification.

Sourcing from distant or complex geographies increases exposure to delays, disruptions, and inventory risk. A study found that increased delivery delays for foreign inputs caused output loss and price increases – indicating lead‐time risk is real.

Global sourcing managers cite longer lead times, political and logistic uncertainties among top risks.

In operational terms: sourcing teams assess how responsive suppliers are to urgent orders, how fast tooling changes or corrective actions can be implemented, and whether lead‐time buffer and quality-risk mitigation are built in.

Brand risk and recall cost: A recall can cost tens of millions. For example, one article states: “77 % of food, beverage and consumer‐product companies that experience a recall … cost can be as much as US$30 million per recall.” Supply & Demand Chain Executive

Complexity of global supply chain: Sourcing farther afield may reduce unit cost but adds layers of risk – quality control, compliance, logistics, currency, transparency. One article notes the hurdles: “All of the hurdles add cost or increase risk or both.” Strategy+business+1

Quantifiable vs hidden cost: While logistics and duty are relatively visible cost items, quality, compliance, defect‐costs and lost customer trust are often hidden yet material

Statements from Sourcing Leaders & Global Publications;

“Product recalls are becoming a daily occurrence … 39 % of respondents said the cost to rectify one product recall ranged from US$10 million to US$49.99 million in the U.S. alone.”

Source: SupplyChainBrain article, September 6 2024. Supply Chain Brain

Context: Emphasizes how significant recall cost has become in the sourcing/quality decision.“Costing on average US$10 million, product recalls are understandably any company’s worst nightmare … almost 50% of brands are still unable to execute product recalls within hours.”

Speaker: Simon Ellis, Practice Director, Supply Chain Strategies for IDC Manufacturing Insights. Source: RedPrairie Corp study via SDCExec, June 15 2012. Supply & Demand Chain Executive

Context: Draws attention to traceability, speed of response, supplier visibility as part of the sourcing/quality trade-off.“Risk and resilience in consumer-goods supply chains … disruptions lasting a month or longer now occur every 3.7 years, on average, with a cumulative cost to consumer-goods companies of one-third a year’s earnings every decade.”

Source: McKinsey & Company article, January 20 2022. McKinsey & Company

Context: Quantifies the financial impact of supply-chain disruptions, relevant to sourcing decisions about lead time, location, risk.“Risk is now front and center in every sourcing decision and in the management of every complex supply chain.”

Source: Proxima Group Global Sourcing Risk Index 2025. McKinsey & Company+1

Context: Speaks to senior-level mindset: sourcing decisions aren’t just about cost, but risk management.“The philosophy that guides your network planning decision-making is to minimize total landed costs subject to meeting defined customer service goals.”

Source: Material Handling & Logistics USA article. Supply & Demand Chain Executive

Context: Supports your “true landed cost” concept (unit cost + logistics + duties + risk).“The entire end-to-end process must be strategically planned and systematically managed with an emphasis on mitigating any risk from suppliers.”

Source: Quality Assurance Magazine article. Focal Point -

Context: Emphasizes supplier risk, quality, visibility — ties into lead-time, defect-tolerance, sourcing country choice.“5 Critical Questions CEOs Should Ask for Supply Chain Risk Management … Q1. Do you know the cost of supply-chain disruption?”

Source: Source Intelligence blog, November 24 2020. Source Intelligence Blog

Context: High-level executive viewpoint: sourcing decisions are strategic, crossing cost, risk, agility.“When product recalls happen, firms not only have to incur additional logistics costs but also suffer from a damaged reputation.”

Source: Research paper “Product Sourcing and Distribution Strategies under Supply Disruption and Recall Risks”. ResearchGate

Context: Academic support for your point about defect/risk cost beyond direct manufacturing cost.“Failures in the supply chain need to be addressed to mitigate risk … companies must remain vigilant to risks throughout their supply chains and regularly review their product recall insurance.”

Speaker: Ian Harrison, Partner for Product Recall at McGill & Partners. Source: Insurance Day article, January 7 2025. Insurance Day

Context: Focuses on supply-chain complexity, traceability, financial exposure in sourcing decisions.“Companies use MIT research to identify and respond to supply chain risks … ‘We are not focusing on the state of the supply chain right now, but what may happen six weeks from now…’”

Speaker: David Simchi‑Levi, Professor at MIT Schwarzman College of Computing. Source: MIT article, June 15 2022. cee.mit.edu

Context: Emphasises forward-looking risk and agility, which sourcing/quality executives must incorporate.

🚀 The Smart Way to Choose Vendors

Step-by-Step Guide by QIV Global for Smarter, Safer Vendor Selection

🌟 Why Vendor Selection Matters

Choosing the right vendor isn’t just about price or contracts — it’s about finding a partner who drives growth, protects your reputation, and strengthens your supply chain.

The wrong choice can cost millions. The right choice gives you a competitive edge, improves operational efficiency, and ensures consistent product quality.

🔹 Step 1: Start with Clarity — Define Your Needs

Before sending proposals, ask yourself:

“What does my business truly need today — and in the future?”

Gather insights across departments — procurement, finance, IT, operations — and categorize requirements:

Must-Haves: Compliance, technical standards, delivery capacity

Nice-to-Haves: Value-added services, sustainability, flexibility

“Most supplier relationships collapse because of cultural misalignment, not technical gaps.” — Martin VanTrieste, CEO, Civica Rx

🔹 Step 2: Research & Shortlist Smartly

Filter potential vendors by:

Pricing & cost structure

Product/service quality

Certifications & compliance

Location & logistics

Reputation & reliability

Supplier Scorecard Example:

| Criterion | Weight | Example |

|---|---|---|

| Quality & Performance | 30% | Defect rates, certifications |

| Cost Efficiency | 25% | Total cost of ownership, payment terms |

| Delivery Capabilities | 20% | Lead times, logistics coverage |

| Technical Expertise | 15% | Industry know-how, innovation |

| Financial Stability | 10% | Credit scores, financial reports |

Scorecards ensure fair, data-driven decisions, not guesswork.

🔹 Step 3: Send RFPs That Invite Real Answers

Send structured RFPs with clear questions about:

Technical capability

Costs & payment terms

Timelines & risk management

Sustainability & ESG compliance

“Supplier scorecards create fairness — decisions based on evidence, not instinct.” — Gary Gustafson, G-Force Consulting

🔹 Step 4: Assess the Risks

Check suppliers for:

Financial stability

Regulatory compliance

Cybersecurity & data protection

Geopolitical exposure

ESG & sustainability practices

Tip: Diversify suppliers to reduce dependency and strengthen resilience.

“Relying too heavily on one region is a vulnerability no company can afford.” — Sheng Lu, University of Delaware

🔹 Step 5: Conduct Due Diligence

Validate vendor claims via:

References & site visits

Product samples & demos

Certifications & audit reports

Delivery reliability & problem-solving capabilities

Example: Morgan Stanley faced multi-million-dollar penalties in 2016 due to inadequate vendor due diligence.

🔹 Step 6: Seal It Right — Contract & Commit

Negotiate a contract that includes:

Clear SLAs & KPIs

Penalties for non-performance

Delivery schedules

Confidentiality & compliance clauses

Exit clauses & dispute resolution

Strong contracts create trust, accountability, and long-term partnerships.

💡 Final Thoughts

Vendor selection is about building partnerships, not transactions. Follow QIV Global’s 6-step framework to:

Define needs clearly

Research widely

Evaluate objectively

Assess risks

Validate via due diligence

Finalize contracts thoughtfully

Strong vendors → Strong supply chains → Strong brands

✅ Ready to Choose Your Next Vendor with Confidence?

Contact QIV Global Today and let our experts guide you to smarter, safer, and future-ready supplier partnerships

International Sourcing Dashboard

Analyze sourcing countries, product categories, inspection status, compliance risk, and lead times in one view.

| Region \ Category |

|---|